Love in your heart and abundance in your pocket.

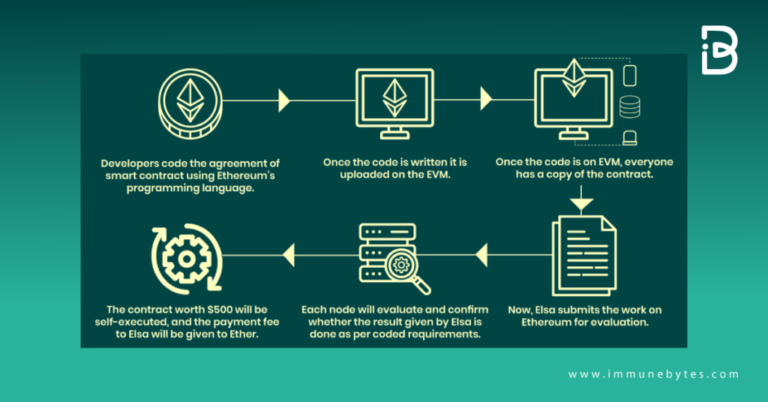

The full moon on January 14 began a turbulent period for cryptocurrencies and all world markets. Geopolitical risks and protectionist policies were at the forefront, causing people to evaluate events from different perspectives. Especially when we look at whale movements in 2021, similar strategies are likely to be experienced in the week of January 16 – January 20. Being compassionate during the full moon I had stated that the full moon, in particular, affects financial astrology and triggers protective, security-oriented emotions. I also stated that we are open to accidents, but when I explained these, not many people followed the…