Waiting for the right time in financial markets

As you know, we all try to be active in financial markets to create additional sources of income for ourselves. Our risk appetite, the feeling we feel when opening a transaction, brings together many people who think like us. So, if everyone wins, who loses in the stock market?

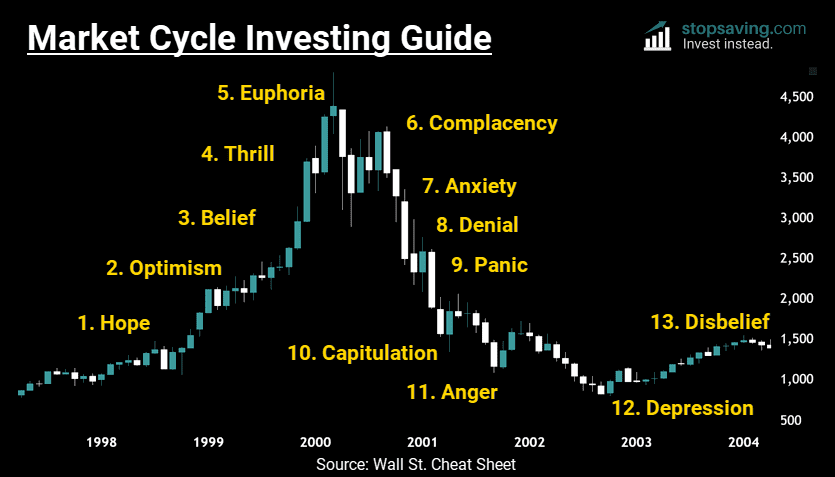

As we know, our desire to have a limited money supply leads us to passive income methods. One of the topics I have been working on the most since last year is the market cycle. When I listen to expert economists and strategists in their fields, they always state that our capital protection strategy should be strong. So, how do we take risks if our situation is bad and we are not satisfied with our job?

In my previous article, I mentioned Mert Başaran’s revenue-cost=income theory. The first option for improving income levels in the country and the world is to cut costs and create idle cash.

The second option is mathematics. Exponents are a subject that even those who do not know mathematics can now calculate on their phones; for example, an investor who opens 100 transactions by setting a 2 percent profit target and guesses them correctly will have his money multiplied by 7.24 times. Generally, in financial markets, people’s laziness and the easy assumption that money in the stock market is easy, instead of making small profits from high-value stocks, aiming to make high profits from low-value stocks means making the ones they have.

Have dreams, have hope.

Don’t be afraid of what others will say: “Oh, I might lose money.” Of course, it is easy to say this: If a person has some savings, it is easier to make financial decisions, but in life, no one usually promises you your dreams for free. The reality of life is to struggle, which is determined by strategies with a clear beginning and end. Set a goal, achieve it, and leave this world having achieved your dreams.

Don’t be sad if you lose, don’t be happy if you win.

Winning and losing are realities of life. People fail and win in the stock market and life. But it is important to get back on their feet and not give up. And accept that you can make mistakes. On the one hand, I have been a basketball player in the past. There are matches won and lost in life, but the important thing is not to give up. Not with luck, but with people who combine mathematics and luck, but with analytical intelligence, anyone can achieve this.

I would also like to share the market cycle from which you can benefit.