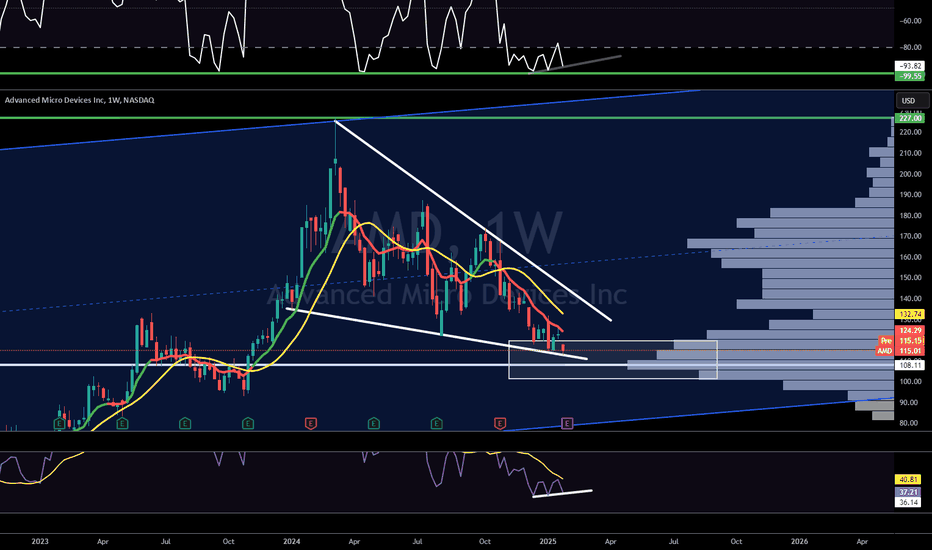

After AMD’s balance sheets were announced, high sales resulted in an 8 percent stock price loss, especially in the US stock exchanges.

AMD, namely Advanced Micro Devices, increased by 24 percent compared to its last quarter turnover, from $6.2 trillion to $7.7 trillion, while its balance sheets have increased significantly from year to year.

When investors compare it to NVIDIA, although their balance sheets come in lower rates, the insufficient growth of artificial intelligence chips and the excessive growth of their turnover and gross profit showed severe imbalances in the balance sheet.

When we examine the Gross Profit and Turnover ratios, the GAAP ratio increased by 3 times while the Non-GAAP ratio increased by 2. This was one of the essential elements showing the imbalance in their balance sheets.

When we look at the profit per share ratios, there is no significant change. Still, after the balance sheets are announced, the most significant change seems to be because while the GAAP in operating income, that is, gross profit, has tripled, the increase rate in turnover has doubled.

While the quarter-to-quarter growth rates are 9 and 11 percent, when we emphasize the annual growth, it is almost 121 percent.

This again warns us not to invest in companies whose balance sheets have changed disproportionately.